Hadoop is the Apache-based open-source Framework written in Java. It is one of the famous Big Data tools that provides the feature of Distributed Storage using its file system HDFS (Hadoop Distributed File System) and Distributed Processing using the Map-Reduce Programming model. Hadoop uses a cluster of commodity hardware to store and run the application.

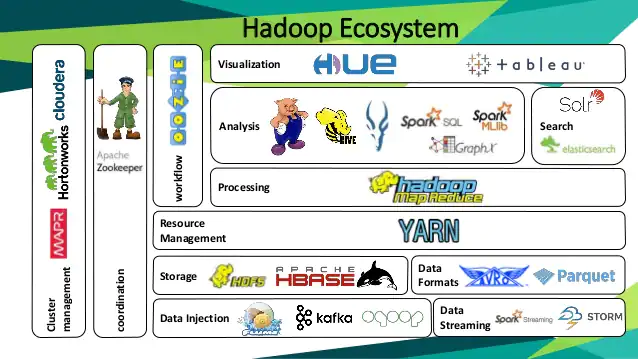

Since Hadoop uses a distributed computing model to process the Big Data and thus we can use Hadoop for Banking and Financial Sector. It also provides lots of features that improve its power. Hadoop provides Low Cost, Fault Tolerance, Scalability, Speed, Data Locality, High Availability, etc. The Hadoop Ecosystem is also very large and provides lots of other tools as well that work on top of Hadoop and makes it highly featured.

What are the key features of Hadoop to use it for banking and financial sector?

- Reliable– Fail Safe technology that prevents loss of data even in an event of hardware failure.

- Powerful– unique storage method based on distributed file system resulting in faster data processing.

- Scalable– stores and distributes datasets to operate in parallel, allowing businesses to run applications on thousands of nodes.

- Cost-effective– runs on commodity machines & network

- Simple and flexible APIs– enables a large ecosystem of solution providers such as log processing, recommendation systems, data warehousing, fraud detection, etc.

How is Hadoop revolutionizing the Banking & Finance Industry?

It is the banking sector that secures our money, but it is Apache Hadoop that secures the unstructured data of those banks and is used for industrial purposes. The banking and financial firms have got a huge amount of unstructured data that only Hadoop has the capacity to store in streams. Many banks use Hadoop technology, which gives rooted analysis to improve the security team and protect our investments and savings.

For the last two decades, the banking sector has suffered drastic changes due to the security of the deposit they keep holding in their big and strong lockers. Thus, in order to avoid those crises and move towards efficiencies and fraud detection, fast finding and a high-level guard is a must. Hence, the marketing and financial domains are running towards Apache Hadoop for high encryption and deep analysis with 100 percent correct statistics.

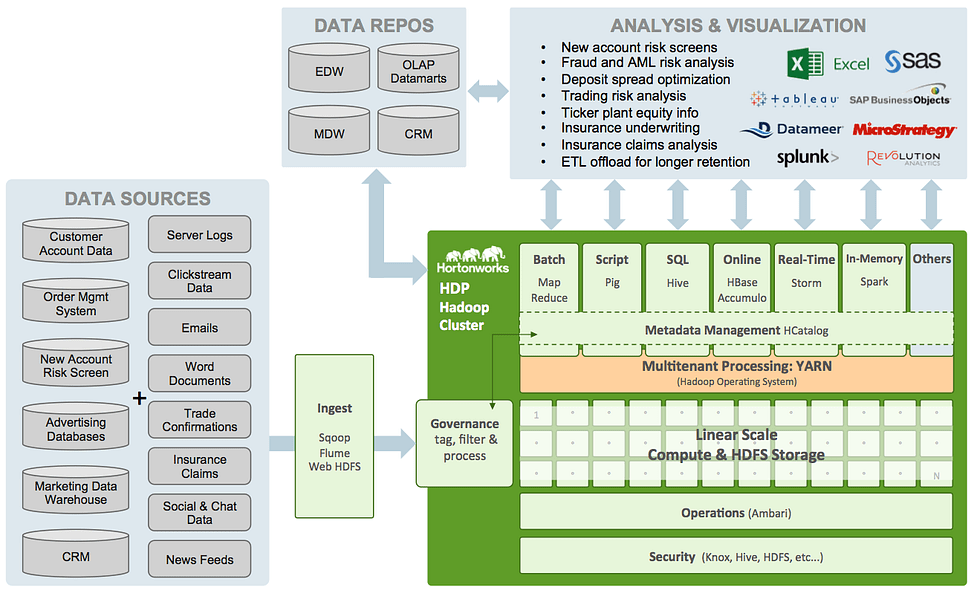

Source – Hortonworks

How is it used in banking and finance?

The reason for Hadoop’s success in the banking and finance domain is its ability to address various issues faced by the financial industry at minimal cost and time. Despite the various benefits of Hadoop, applying it to a particular problem needs due diligence. Some of the scenarios in which Hadoop is used for the banking and financial industry are:

Fraud Detection

Hadoop addresses most common industry challenges like fraud, financial crimes and data breaches effectively. By analyzing point of sale, authorization, and transactions, and other points, banks can identify and mitigate fraud. Big Data also helps in picking up unusual patterns and alerting banks of the same, while also drastically reducing the time and resources required to complete these tasks.

Risk Management

Assess risks accurately using Big Data Solutions. Hadoop gives a complete and accurate view of risk and impact, enabling firms to make informed decisions by analysing transactional data to determine risk based on market behaviour, scoring customers, and potential clients.

Data Storage and Security

Protection, easy storage, and access to financial data are the optimal needs of banks and finance firms. While Hadoop Distributed File System (HDFS) provides scalable and reliable data storage designed to span large clusters of commodity servers, MapReduce processes each node in parallel, transferring only the package code for that node which is one of the greatest advantages of using Hadoop for Banking and Financial Sector. This means information is stored in more than one cluster but with additional safety to provide a better and safer data storage option.

Analysis

Banks need to analyze unstructured data residing in various sources like social media profiles, emails, calls, complaint logs, discussion forums, etc. as well as through traditional sources like transactional data, cash, and equity, trade, and lending, etc. to get a better understanding of their customers. Hadoop allows financial firms to access and analyze this data and also provides accurate insights to help make the right decision.

Hadoop is thus a most ideal choice for the banking and financial industry and is also used in other departments like customer segmentation and experience analysis, credit risk assessment, targeted services, etc.

Written By | Ashutosh Yadav